If you plan to buy a house, you first need to find out how big of a loan you can afford and how high monthly payments you can make. A mortgage is designed to assist you in buying a house. However, if you miss a single payment, you risk foreclosure.

Lenders vet borrowers thoroughly to find out their financial status. Apart from making a soft inquiry into your credit score, they ask for personal information to determine whether you can keep up with the monthly payments.

So, wouldn’t it be better to find your financial stability before getting rejected by a lender? There are plenty of online mortgage calculators that allow you to find out your monthly payments based on the following four factors:

- Loan Amount

- Down Payment

- Length of the Loan

- Interest Rate

Here’s how these four factors are related:

Your loan amount is approved based on your credit score, which helps the lender decide the interest rate. You can lower the interest rate by making a 20% or more down payment. This option will reduce the principal amount you have to borrow. As for the length of the loan, the more years you take to repay the loan, the more you will pay in interest.

If you choose a 15-year mortgage instead of a 30-year one, you will pay less interest rate. However, remember that your monthly payments will be high.

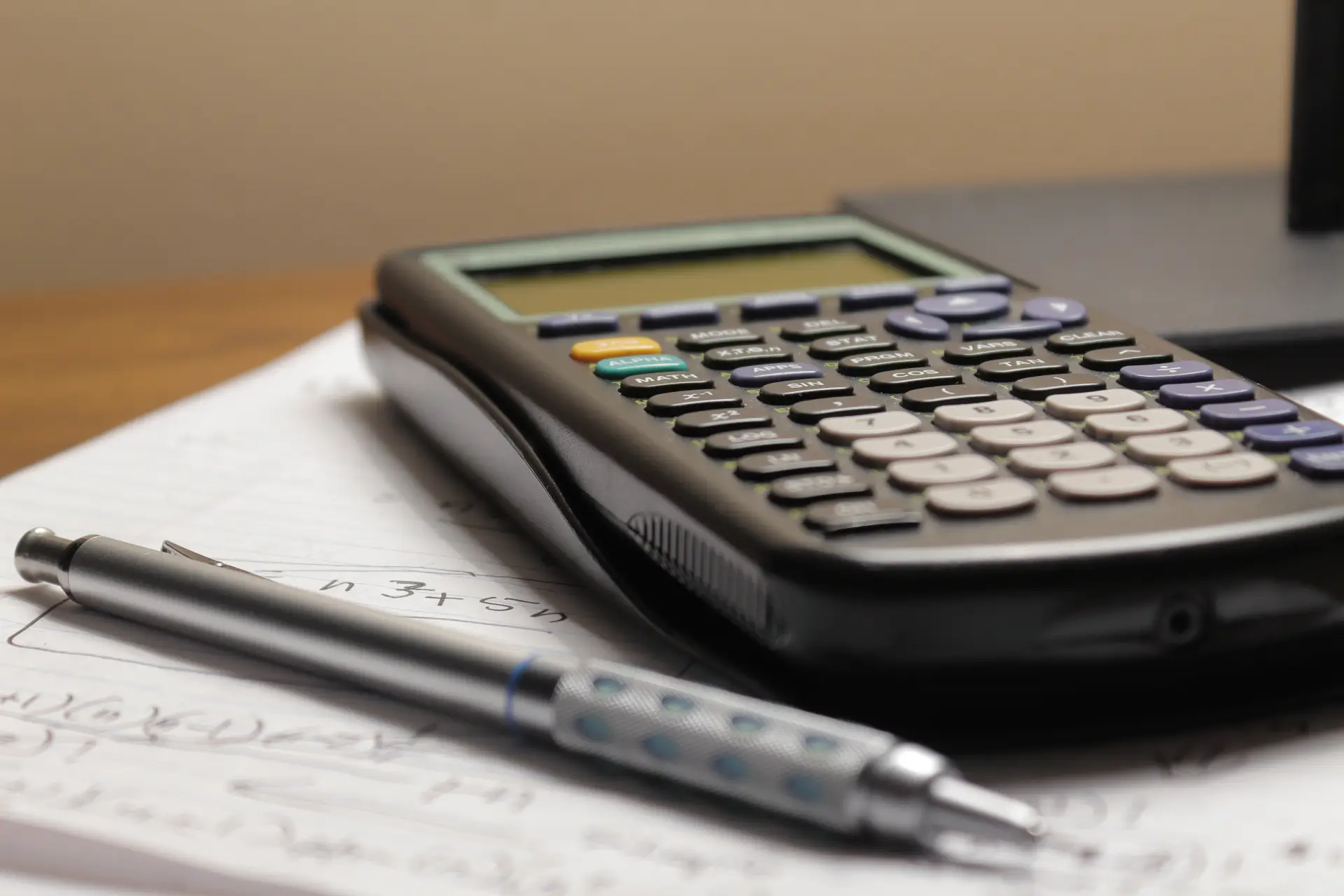

Calculating Mortgage Manually

Another way to calculate your monthly mortgage payment is using the following equation: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

- “P” stands for principal and is the loan amount you borrow. For example, the house you want to buy costs $300,000. You make a down payment of $40,000. This option leaves you with a loan principal of $260,000.

- “i” stands for monthly interest rate. The interest rate you see on the mortgage documents is used to calculate annual payments. To find the monthly interest rate, divide the annual interest rate by 12. So, if the annual interest rate is 4%, your monthly interest rate will be: 4/12 = 0.3333

- “n” stands for the repayment period. So, if you have applied for a 30-year mortgage, the repayment period will be 30 x 12 = 360 months.

The Amortization Schedule

This refers to the payments made throughout a mortgage, which are dedicated to the monthly principal, interest, taxes, and insurance (PITI). The first 12 payments cover interest and the rest principal.

For example, you are getting a $100,000 home loan with a 30-year period. The amortization schedule will have a total of 360 payments. The following table shows how the balance between interest and principal payments changes over time.

| Payments | Principal | Interest | Principal Balance |

| 1 | $99.55 | $500.00 | $99,900.45 |

| 12 | $105.16 | $494.39 | $98,772.00 |

| 180 | $243.09 | $356.46 | $71,048.96 |

| 360 | $597.00 | $2.99 | $0 |

If you add the interest and principal, you will see that each amount is $599.55. Since you pay more interest in the first year, your equity builds slowly.

You can increase your principal payments if your lender permits you to do so. As your principal will reduce, so will the interest on each payment.